BLOG POST

Following our recent proof-of-concept study looking at the relative online prominences of the top twenty fashion brands of 2023[1], we extend the idea to analyse the top 100 most valuable global brands overall, using a much larger set of webpages and looking at not only the prominence of the brands, but also the sense of the sentiment of the respective mentions. Whilst brand prominence is relevant to areas such as search-engine optimisation, web-traffic analysis and brand valuation, the addition of sentiment to the analysis can provide information relating to customer perception and brand value, and allows factors such as the impact of news stories and marketing initiatives to be tracked.

Overall, we find Google to be the most prominent brand by a significant margin (prominence score: 2.856), followed by Microsoft (0.670), LinkedIn (0.655), Amazon (0.637) and Facebook (0.523). We also find a (weak) positive correlation between online brand prominence and brand value, though the latter metric (as provided by Kantar[2]) also takes into account other factors, specifically characteristics pertaining to the ability to generate revenue.

Various social-media and search brands (Google, Facebook, LinkedIn, Instagram and YouTube) and technology brands (Oracle, Salesforce and SAP), are disproportionately more prominent than might be expected on the basis of their brand value, reflecting both their general overall online ubiquity and the frequency of their mentions in web content relating specifically to business. Conversely, some luxury brands (Louis Vuitton, Hermes, Chanel) have lower prominences, potentially reflecting a lower reliance on search-engine optimisation, and an increased reliance on brand reputation, to drive users to their online content.

The top five most positively referenced brands (by sentiment) are Amazon (22.48), Microsoft (21.47), Google (20.81), Facebook (13.67), and Apple (13.48). The most negatively referenced brand is ICBC (-2.71), in part due to references to the recent cyber-attack against the organisation.

In future more-detailed studies, the methodology could be further refined by the introduction of other ideas, such as: the use of additional search terms, other languages, or region-specific search sources; customisation of the lists of sentiment keywords and/or the use of keyword-based relevance filtering; or separation of official from third-party brand references. These approaches could allow for more focused analyses, such as industry-specific deep-dives giving insight into customer comment.

References

[1] https://www.iamstobbs.com/measuring-brand-prominence-of-fashion-brands-ebook

[2] https://www.kantar.com/inspiration/brands/revealed-the-worlds-most-valuable-brands-of-2023

This article was first published on 5 January 2024 at:

* * * * *

WHITE PAPER

Executive Summary

- In this study, we present a new methodology for measuring the online prominence and sentiment of a group of brands, and apply the approach to the top 100 most valuable global brands in 2023. The metrics are likely to be linked to factors associated with search-engine optimisation, web traffic, brand valuation, and customer perception, but can be produced using a much more simplified and scalable approach.

- The analysis is based on a dataset of over 4,300 of the most highly-ranked webpages returned by google.com in response to searches for a set of 50 generic business-related keywords.

- The measurement of brand prominence is built on the concept of a 'brand content score', a metric representing the degree to which a webpage can be considered to be 'about' a brand (or other keyword) of interest, considering both the number of mentions and the prominence of those individual mentions on the page.

- The measurement of sentiment is carried out by considering the proximity of the brand mentions to any of a pre-defined library of positive and negative sentiment keywords.

- Google was found to be the most prominent brand by a significant margin; the top five brands (and their prominence scores) are: Google (2.856), Microsoft (0.670), LinkedIn (0.655), Amazon (0.637) and Facebook (0.523).

- There is a positive (though relatively weak) correlation between online brand prominence and brand value, with three of the top four most prominent brands (Google, Microsoft and Amazon) appearing in the top four of the Kantar brand value index. However, the Kantar list also reflects other brand factors relating to the ability to generate revenue, so it is perhaps not surprising that the overall correlation is not stronger.

- The group of brands which are disproportionately more prominent than would be expected by virtue of their brand value is dominated by those in the social-media and search sectors (Google, Facebook, LinkedIn, Instagram and YouTube) and the technology sector (Oracle, Salesforce and SAP), reflecting both their general overall online prominence and the frequency of their mentions in web content relating specifically to business.

- Certain luxury brands (Louis Vuitton, Hermes, Chanel) are notable for their relative low prominence in the dataset of webpages considered, perhaps reflective of their lower reliance on search-engine optimisation, and increased reliance on brand reputation, to drive users to their online content.

- Considering also a set of large Internet and/or social-media brands which do not feature in the overall list of top 100 most valuable brands, Twitter / X was found to be the most prominent. Overall, it appears in fifth place (between Amazon and Facebook) when ranked within the main list of brands.

- The top five brands in the dataset by online sentiment are: Amazon (22.48), Microsoft (21.47), Google (20.81), Facebook (13.67), and Apple (13.48). The top four most valuable brands overall all appear in this top five. The most negatively referenced brand overall is ICBC (-2.71), in part due to references to the recent cyber-attack against the brand.

- Future applications of this analysis might involve consideration of more focused sets of brands, potentially using industry- or product-related search terms and/or specific channels of interest, to gain a deeper dive into content areas such as customer comment. Use of a consistent approach in any given study will also allow trends over time to be tracked, thereby allowing analysis of the impact of marketing initiatives, product launches or news stories.

- Areas for development might include the use of more comprehensive keyword-based filtering keywords to exclude generic references to brand terms, 'tuning' of the sentiment keyword libraries to better suit specific areas of content, more in-depth analysis to separate 'official' brand references from 'unauthorised' use, and the use of region-specific searches and local-language search and matching terms, to better sample content relating to international brands.

Study overview and methodology

Introduction

The online prominence of brands can be a key metric for brand owners, and can serve as a data input for a number of areas, including search-engine optimisation and web-traffic analysis, and brand valuation. Overall, it provides a measure of the amount of accessible brand-related online content - both official and third-party - and can also provide an indication of the likelihood of a brand being targeted by infringers. The sentiment associated with brand mentions is also of key significance, providing information relating to customer perception and brand value, and allowing factors such as the impact of news stories and marketing initiatives to be tracked.

In this study, we present the results of an analysis of the online prominence and sentiment of the top 100 most valuable global brands in 2023[1] (Appendix A), using newly-developed metrics. The methodology for measuring brand prominence is essentially identical to that used in an initial proof-of-concept study of the top twenty fashion brands[2].

Methodology

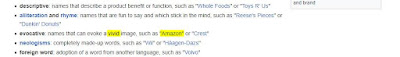

1. Brand prominence

The basic principle behind the methodology to measure online brand prominence is to obtain a representative sample of webpages of potential relevance (e.g. to the business area of the brands concerned) and then determine the number and prominence of mentions of each of the brands of interest on each webpage, across the dataset.

One of the main points to note in this type of analysis is that it is necessary not to explicitly search for any of the brand names in question. The reason for this is that - by definition - for any given query submitted to a search engine, all of the results will relate to the search term being used. Even if the analysis considers all such results, by continuing to paginate through until no further results are returned, this will usually only return a maximum number of results (typically a few hundred) for any given search engine and query. If, therefore, we simply search for each brand name separately, this will yield a relatively consistent number of results for each brand, and the brands will artificially appear to have similar online prominences. Instead, it is preferable to use generic search queries to bring back sets of pages relevant to the industry area of the brands in question (or to business in general) and count the mentions of the brands (and measure their prominence in each case) which happen to appear in this overall representative sample of pages.

In this analysis, we consider the content of a set of webpages returned in response to searches on google.com for each of 50 keywords related generally to business ('business', 'company', 'employer', 'industry', 'profits', 'revenue', etc.), considering the first page of (approximately 100) results in each case. The list of links was then de-duplicated, to retain the unique URLs, of which there were 4,376[3].

The next stage is, for each of the 100 brands under consideration, to measure the number and prominence of the mentions of the brand on each of the pages in the dataset. In general, prominence is determined by the type of context in which the brand is mentioned (e.g. in the URL vs. the page title vs. a level-1 or level-2 heading vs. any other mention on the page); this analysis is carried out by considering the full content of the HTML source-code of the webpage.

Brand mentions are identified by matching the content of the webpage HTML using 'regular expressions' ('Regex'), a formulation which allows wildcard-based searching and is able to identify brand references within longer strings (such as the URL of the page). However, because this approach is taken, it was necessary to construct the match-terms in such a way so as to avoid non-relevant false positives in cases where the brand names could appear within longer acronyms or as substrings within longer words (e.g. for 'Chase', we wish to exclude terms such as ‘purchase’). In order to do so, for brand names where this may be an issue, we match only for brand appearances where they are preceded / followed by characters other than letters. Where appropriate, brand variations were also included in the matching (e.g. for 'TCS' (Tata Consultancy Services) we also consider references to 'tata.?consult.*', where '.?' is any optional one character and '.*' is any number of characters). Similarly, for the most generic brand names, the matching terms were modified in order to require a specific additional qualifying term (as is usually used in conjunction with the brand name) to be present, to minimise false positives. The brands modified in this way were:

- For TD, the matching term was modified to require the webpage to reference 'td.?bank' (where '.?' is an optional character) specifically, in order for a brand reference to be deemed to have been identified

- For JD, the matching term was modified to require the webpage to reference 'jd.?com' (or 'jingdong') specifically

These changes will mean that some relevant mentions (referencing just 'TD' or 'JD') may be missed, but are intended to provide an overall more realistic reflection of the amount of brand-relevant content.

In earlier formulations of similar methodologies[4,5,6], the subsequent analysis was carried out simply by considering the numbers of pages on which there was at least one brand mention in each of the key areas of content (URL, title, etc.) on the page. However, this approach is somewhat unsatisfactory, as it fails to distinguish (for example) a page which mentions a brand once in its page title from one featuring multiple mentions in the title (and, correspondingly, actually has a greater degree of 'brand-related' content). In this study, we present an improved methodology, utilising the concept of a 'brand content score' for each brand on each page.

Brand content score

The brand content score (which can be calculated for a specific brand or keyword on any given webpage) is a useful metric in its own right, with general applications in a range of areas.

Its calculation involves counting each mention of the brand on the page, and weighting each one according to its prominence - e.g. a mention in the URL 'scores' more highly than a mention in the page title, which scores more highly than a mention in a level-1 heading, and so on. In our formulation, we also have the option to 'cap' the contribution to the total score from each specific area, to avoid skewing the results by 'junk' pages which may be 'stuffed' with very large numbers of mentions of random terms.

The range of scores obtained by this analysis will be dependent on the relative weightings and data caps used, as well as the types of search queries used to generate the results and the keywords being matched.

In brand monitoring, brand content score can also be used as a basis for prioritising results - for example, when large numbers of webpages are identified using a monitoring tool. Those pages assigned the highest scores - i.e. those of greatest potential relevance to the brand in question - are typically the primary targets for further analysis, may be priorities for further monitoring (e.g. content tracking) and enforcement, and can provide insight into keywords and TLDs (domain extensions) most used in relevant content, which can help inform domain registration policies[7,8].

In this analysis, we calculate the brand content score for each brand under consideration, for each webpage in the dataset, and use the mean value across all pages for each brand as the basis for the comparison of the relative online prominence of the 100 brands.

In some cases, analysis of the page will not be possible (e.g. if the page returns an HTTP status code deemed to be an error code).

2. Brand sentiment

For each identified mention of any of the brands under consideration on each webpage, we also calculate a sentiment score, indicating the 'sense' of the references ('positive' or 'negative'). The basic formulation is as follows:

- For each webpage under consideration, the overall sentiment score for each brand is based on the proximity of each mention of the brand to any of a library of 'positive'[9] or 'negative'[10] keywords[11].

- In this simplest formulation, all keywords are deemed to be of equal 'strength', and the score assigned to each instance of a sentiment keyword near to a brand mention is determined according to just their proximity, using an exponentially decaying function (so that instances where the pair of words appear more closely together will be assigned a higher score) (Appendix B). The maximum score (assigned where the words appear adjacently on the webpage - i.e. a proximity of 1 word) and the rate of decay of the score with increasing proximity (the 'proximity half-life') can both be chosen. In this study, we use a maximum score of 100 and a proximity half-life of 1 word.

- For each mention of each brand on a webpage, the nearby words (up to a maximum proximity; the distance at which the proximity score drops to zero) are inspected, to determine if any of these are sentiment keywords from the keyword library. If so, the proximity score is calculated according to the distance between the two words. If the keyword is positive, the appearance will be assigned as a positive score component, and vice versa. The total positive and negative scores for each brand can then be calculated, and the overall sentiment score for the brand on the page in question is the difference between the two (i.e. overall sentiment score = positive sentiment score - negative sentiment score). An illustration of how this technique works in practice is shown in Appendix C.

The following details relating to the specifics of the analysis may be noted:

- The text-content of the page is 'cleaned' by removing any line-breaks, tabs or other punctuation symbols ( - ' " , . ; : & * ( ) @ # / ) and any instances of multiple consecutive spaces. The remaining content of the page is split into a list of words, for analysis.

- A brand- or keyword mention is deemed to have been identified only if it is an exact mention. This requires each brand name (and keyword) to be represented as a single string (word) with no punctuation characters, and any variant brand references on the page to be replaced with the brand name in the same format prior to analysis (e.g. "coca-cola" and "coca cola" are replaced with "cocacola"). The same approach can be taken with other brand references deemed to pertain to the brand in question (e.g. "lvmh" is replaced with "louisvuitton").

- It was also necessary to make the following modifications to the lists of keywords:

- The following terms were removed from the library of negative keywords*:

- 'cloud' - this term is referenced frequently in relation to IT, and would otherwise skew the results, particularly for brands such as Google, Oracle, Shell (where the term can be used in reference to its software definition), etc.

- 'sap' - this term is indistinguishable from the SAP brand name, and would otherwise mean that every mention of SAP would be (by definition) in immediate proximity (separation zero) with a negative keyword, such that it would not be possible to get a meaningful sentiment measure for this brand.

- 'limited' - this term occurs frequently as a neutral keyword in a business-related context (as part of company names, etc.).

* For more robust future studies, it may be necessary to carry out a more detailed edit of the keyword lists and/or to create bespoke lists for particular industries or business areas.

- The following other modifications were also made, to prevent brand confusion / false positives:

- Explicit references to 'start(-)ups' and 'ups(-)and(-)downs' were removed from all webpage content prior to analysis, to prevent confusion with the UPS brand.

- The most straightforward formulation of the overall sentiment score for each brand would then be to calculate it as the mean of the sentiment scores on all pages on which a reference to that brand was identified. However, this approach raises the possibility that the score could be affected by a small number of 'outliers' with extreme scores (as might arise from false-positive brand references or 'junk' pages 'stuffed' with large numbers of keywords). Accordingly, we adopt the same approach as used in previous similar studies[12], namely:

- Before calculating the mean across all pages, the cube root is taken of the raw overall sentiment scores for each brand on each page, to reduce the impact of outliers.

- The average sentiment score is then multiplied by the square root of the number of contributing webpages. This provides a measure of significance, and upweights the score for brands where the mentions are consistently positive or negative, and downweights it for brands for which the scores would otherwise be 'skewed' due to the fact that only a few relevant pages had been identified.

Findings

1. Brand prominence

The overall prominence scores for the brands (calculated as the mean of the brand content scores across all webpages in the dataset) are shown in Figure 1 and Appendix D.

Figure 1: Overall prominence scores for the top thirty most prominent brands (out of the set of 100 most valuable brands)

Figure 2 shows a comparison between the overall prominence score and the ranking in the Kantar list of most valuable brands, for each of the top thirty most prominent brands.

Figure 2: Comparison of overall prominence score with Kantar ranking, for the top thirty most prominent brands (excluding Google)

Overall, Google is the most prominent brand within the set of webpages considered, by a significant margin, followed by Microsoft, LinkedIn, Amazon and Facebook. There is also a weak correlation between the ranking of the brands (according to the Kantar index) and their prominence scores, with many of the more highly ranked brands having higher prominences. For example, three of the top four most prominent brands (Google, Microsoft and Amazon) appear in the top four of the Kantar index.

Note that the ordering of the brands is different from that where we consider only the total number of pages within the dataset on which a brand mention was identified (Table 1), since the prominence score also takes account of the type of location on the page (i.e. URL, page title, heading, etc.) on which the mentions appear.

| Brand term |

No. pages |

|---|---|

| 1,001 | |

| 843 | |

| youtube | 794 |

| 619 | |

| 476 | |

| amazon | 238 |

| apple | 206 |

| microsoft | 171 |

| tiktok | 110 |

| ups | 85 |

Table 1: Numbers of pages within the dataset on which at least one brand mention was identified, for the top ten most commonly appearing brands

The distribution of brand content page scores, for each of the top five most prominent brands overall, is shown in Figure 3. Overall, the general principle is that the brands with the greatest prominence appear in general on more of the webpages within the dataset, and have greater numbers of pages giving higher brand content scores.

Figure 3: Distribution of brand content page scores, for each of the top five most prominent brands

It is also informative to consider the most highly scored webpages within the dataset, according to individual brand content scores, as shown below.

Top three pages in the dataset, by highest individual brand content score:

- https://about.google/belonging/at-work/

- (brand term: google; score 290)

- https://github.com/googleapis/google-api-pythonclient

- (brand term: google; score 273)

- https://www.immigration.govt.nz/new-zealandvisas/visas/visa/samoan-quota-scheme-resident-visa

- (brand term: visa; score 272)

The top page in the dataset is from an official Google website, which (unsurprisingly) achieves the highest score in terms of the degree to which the content pertains to the Google brand. However, just the presence of an official site in the dataset (returned in response to a generic search query) is significant, giving an indication of the strength of the brand owner's search-engine optimisation strategies.

The third-placed page in the above list is noteworthy because it raises an interesting question about the handling of 'false positives'; the page features numerous prominent references to 'visa', but this is generally in the context of immigration visas, rather than in reference to the credit-card brand. Similar comments will also apply to some of the references of many of the other brands, particularly where the brand name is a generic term (such as 'shell', 'chase' or 'ups') or can appear in other contexts, including usage by other brand owners (e.g. 'bca' (intended to refer to Bank Central Asia) can also pertain to 'British Car Auctions', 'BCA Leisure', etc.). This is potentially the reason why some of these brands are quite so highly ranked. In more sophisticated formulations of the methodology, these 'false positives' could be accounted for (to a degree) via the use of 'positive' (relevance) or 'negative' (exclusion) keywords. However, because of the very large numbers of possible such permutations, and the desire to treat all brands equally (as far as possible), no further 'corrections' along these lines have been applied in this study. Arguably, the fact that the overall scores reflect both 'legitimate' brand references and 'other' uses of the brand term does provide useful information on the extent to which the brand name is used online - which relates to issues such as brand distinctiveness and brand dilution. Any attempt to separate these two types of brand reference would require a much more in-depth analysis.

Considering next a deeper dive into the prominence data, we consider the correlation between prominence score and absolute brand value as given by the Kantar analysis (rather than just the relative rankings), and also split the brands by industry area to determine whether any of the trends are sector-specific.

In the original analysis by Kantar, the 100 brands are assigned into 18 different business categories; in our analysis, we adopt a simplified approach utilising 11 different industry areas. These are listed below, together with the Kantar categories to which they correspond (for the cases where more than one category is included or a different descriptor is used).

- Retail

- Alcohol, food and tobacco

- Alcohol

- Tobacco

- Food and beverages

- Fast food

- Apparel and luxury

- Apparel

- Luxury

- Personal care

- Financial services

- Media and entertainment

- Logistics

- Automotive

- Technology

- Business technology and services platforms

- Consumer technology and services platforms

- Conglomerate (Siemens)

- IoT ecosystem (Haier)

- Telecommunications

- Telecom providers

- Energy

The findings are shown in Figures 4 and 5.

Figure 4: Comparison of overall prominence score with brand value, for the top 100 brands, split by industry area

Figure 5: Comparison of overall prominence score with brand value, for the top 100 brands, split by industry area (detailed zoom)

Overall, there is a general positive (though relatively weak) correlation between brand value and our determination of prominence score (overall correlation coefficient = +0.61),

In addition, the following top-level trends are evident:

- Brands which are disproportionately more prominent than would be expected by virtue of their brand value (i.e. those appearing towards the bottom-right of the graphs) are dominated by those in the media and entertainment sector (especially the social-media and search brands Google, Facebook, LinkedIn, Instagram and YouTube) and the technology sector (specifically Oracle, Salesforce and SAP). These observations are likely to be reflective of the ubiquitous nature of the former set of brands, and the frequency with which the latter set of business-service brands are referenced in general business-related content.

- The set of brands which are disproportionately less prominent than would be expected by virtue of their brand value (i.e. those appearing towards the top-left of the graphs) is more varied, but it is notable that many of the luxury brands (Louis Vuitton, Hermes, Chanel) appear in this area. This may be reflective of both the high value of these brands generally, and the extent to which they perhaps need to be less reliant on search-engine optimisation techniques, relying instead on reputation to drive traffic to their online content.

It is also informative to compare the online prominence of these top 100 brands with that of a selection of other brands which are likely to have significant online presences, but do not appear in the list of most valuable brands. In order to do so, we consider a set of 15 of the largest Internet and/or social media brands[13,14,15,16] which do not appear in the list of 100 most valuable brands overall (Appendix E). The same set of 4,376 webpages was then analysed identically as described above, to determine the overall prominence scores of these additional brands[17].

The overall prominence scores for the additional brands are shown in Table 2, which also includes the top ten brands from the main study, for comparison.

| Brand |

Prominence score |

|---|---|

| 2.856 | |

| Microsoft | 0.670 |

| 0.655 | |

| Amazon | 0.637 |

| Twitter / X | 0.524 |

| 0.523 | |

| YouTube | 0.459 |

| 0.431 | |

| Apple | 0.405 |

| Adobe | 0.303 |

| 0.243 | |

| Shell | 0.168 |

| 0.056 | |

| 0.042 | |

| ServiceNow | 0.029 |

| Snapchat | 0.008 |

| 0.003 | |

| Telegram | 0.003 |

| Booking.com | 0.002 |

| Sina Weibo | 0.002 |

| Douyin | 0.000 |

| Baidu | 0.000 |

| Yandex | 0.000 |

| Pinduoduo | 0.000 |

| Kuaishou | 0.000 |

Table 2: Overall prominence scores for the additional large Internet and/or social-media brands (with the top ten brands from the main study shown in bold)

The number of pages on which at least one mention was identified, for each of these additional 15 brands, is shown in Table 3.

| Brand |

No. pages |

|---|---|

| Twitter / X | 1,022 |

| 1,001 | |

| 843 | |

| YouTube | 794 |

| 73 | |

| 56 | |

| 54 | |

| Snapchat | 20 |

| 12 | |

| ServiceNow | 10 |

| Sina Weibo | 8 |

| Telegram | 7 |

| Booking.com | 6 |

| Douyin | 1 |

| Baidu | 0 |

| Yandex | 0 |

| Pinduoduo | 0 |

| Kuaishou | 0 |

Table 3: Numbers of pages within the dataset on which at least one brand mention was identified, for the additional large Internet and/or social-media brands (with the top three brands from the main study shown in bold)

Amongst the additional 15 brands, Twitter / X (for which the latter variant was identified by searching explicitly for 'x.com', to avoid false positives) is noteworthy by having by far the greatest online prominence (actually the only one of the additional brands to appear in the top ten of the overall list), and the greatest ubiquity (in terms of number of pages where a mention was identified), despite not appearing in the list of top 100 most valuable brands overall.

The overall prominence of QQ (the second placed of the additional brands in terms of prominence) is likely to be an over-estimate, due to the generic nature of the brand name, and the potential for false positives. In particular, the string 'qq' seems to appear frequently in the source code of webpages displaying PDF files; if these files are excluded from the dataset, the overall prominence score for QQ drops to 0.028.

2. Brand sentiment

The overall sentiment scores for the top 100 brands are shown in Figure 6 and Appendix F.

Figure 6: Overall sentiment scores for the top thirty most positively referenced brands (out of the set of 100 most valuable brands)

It is noteworthy that the top four most valuable brands (Apple, Google, Microsoft, Amazon) all appear in the top five brands which are most positively referenced overall, with Amazon achieving the most highly positive sentiment score. Part of the reason for this top ranking is the fact that the dataset actually includes several pages from the official Amazon website, together with other sites which are affiliated with the brand, or provide brand-specific information (such as amazonworkspaces.com and aboutamazon.com). An example of one of the highly-scored pages for Amazon is shown in Figure 7; this page can be seen to feature a reference to the brand in conjunction with positive phraseology, consistent with the assertion that the metric is generating meaningful results.

Figure 7: Example of an extract from a webpage including a positive reference to Amazon (sentiment score: +100)

Conversely, the bottom (most negatively referenced) brand in this analysis is ICBC. This appears to be, at least in part, due to news stories surrounding the recent cyber-attack against the brand[18] (Figure 8).

Figure 8: Example of an extract from a webpage on which ICBC is negatively referenced (in conjunction with the negative keywords 'hack' and 'disruption') (sentiment score: -56)

Discussion and Conclusions

The methodology described in this article represents a simple approach for comparing the online prominence and sentiment of different brands, focusing on the most highly-visible online content (i.e. the webpages appearing near the top of the search-engine rankings). Overall, we might expect online prominence to be associated with factors relating to search-engine optimisation, web traffic, and brand valuation, but to be measurable in a much simpler and more scalable way.

The same approach can also be applied to more comprehensive studies, which could incorporate larger datasets of webpages, potentially drawn from a wider range of search sources targeting different geographical markets, and utilising as many relevant search queries as appropriate. It is noteworthy, for example, that the results from this study are dominated by English-language content, using just the google.com search engine (and are potentially also biased by virtue of running the searches from a UK-based IP address). This will undoubtedly contribute to overseas brands being under-represented in the statistics, which could be mediated in future studies by the use of region-specific search-engines and proxy servers, and the use of local-language search terms and brand matching.

In any study of this type, it is important to deal correctly with brand names which are relatively generic, to ensure that references are considered properly and avoid false positives. In such cases, it may be necessary to make use to keyword-based filtering to distinguish the relevant mentions from other uses of the brand name. Similarly, it may be appropriate to create bespoke versions of the sentiment keyword lists which are appropriate to specific industry areas.

Furthermore, providing a consistent approach is used for any given series of studies, the methodology also offers the potential for tracking trends and changes over time in relative prominence (without the need to 'normalise' the scores to a consistent baseline, as was the case in some earlier studies)[19,20,21], allowing factors such as the impact of marketing initiatives or news stories to be tracked.

Overall, the analysis of the top 100 most valuable brands gives (based on a sample of webpages related generally to business) the three most prominent as Google, Microsoft and LinkedIn, and the three most positively referenced as Amazon, Microsoft and Google. There is also a general (though relatively weak) positive correlation between brand prominence and brand value (as determined by the Kantar study). The main exceptions to this observation are social-media / search (Google, Facebook, LinkedIn, Instagram and YouTube) and technology (Oracle, Salesforce and SAP) brands, which are disproportionately highly represented in our dataset of sample webpages, and a selection of luxury brands (Louis Vuitton, Hermes, Chanel), which appear relatively less frequently than might be expected by virtue of their brand value.

Overall, it is not necessarily surprising that there is no strong overall correlation between online prominence and (Kantar) brand value, as they are attempting to quantify distinct brand characteristics. Kantar's report[22] states that their formulation of brand value aims to reflect the financial contribution of the brand to the value of the parent company, and includes direct consideration of consumer perception. Their analysis focuses purely on revenue driven by the brand name under which products and services are sold, as an 'intangible asset', taking into account the following three drivers of value:

- Current demand - the degree to which the brand encourages customers to choose it over competitors

- Price premium - the ability to influence customers to pay more for branded products than for competitors, based purely on the strength of brand equity

- Future demand and price - a reflection of the potential to charge higher prices in the future and to attract new customers

Whilst brand prominence - i.e. online exposure - is part of this picture, there are clearly other factors also at play, and there could certainly be highly valued brands whose business model might mean that they could have little or no significant online presence.

Conversely, it is also noteworthy that Twitter / X is a key example of a brand which has a significant degree of online presence - potentially due, in part, to its legacy popularity - despite currently not being one of the most valuable brands overall.

Similar comments also apply to the recent analagous study of the top twenty fashion brands, where no strong correlation was observed between prominence and brand ranking (according to the Lyst Index[23]). In this case, part of the difference may be that the Lyst metric is also taking account of other factors, such as brand popularity and customer engagement, in addition to brand value, whereas 'pure' online prominence is a much more specific metric.

Regarding the sentiment measurement in this study, it is notable that that this specific analysis is potentially more likely to identify pages which are, in general, relatively 'neutral' or 'positive' (thereby yielding higher scores), due to the use of generic, business-related search terms which are likely to return official or informational sites. It might be possible to gain more meaningful insights into customer comment through the use of vertical-specific deep dives on subsets of companies, using more focused industry- or product-specific keywords.

Whilst the approach outlined in this article is still relatively rudimentary, it does provide a number of useful insights, and could easily be modified and improved to take account of some of the known shortcomings. Specifically, one obvious area for future development would be the incorporation of additional filtering keywords, to exclude 'false positive' brand mentions (i.e. generic use of the brand name). Beyond this, it would also be informative to attempt to separate out 'official' brand uses (e.g. by the brand owner and official partners and representatives) from third-party ('unauthorised') use, though this would be likely to require a much more in-depth analysis.

Appendix A: The top 100 most valuable global brands in 2023

Regex key:

$ End of string

| Or

? Previous character optional

.? Any optional single character

.* Any number of characters

[^a-zA-Z] Any character other than a letter

| Kantar (brand value) ranking |

Brand |

Brand value ($M) |

Category |

Brand term |

Regex matching string |

|---|---|---|---|---|---|

| 1 | Apple | 880,455 | Cons. tech. | apple | [^a-zA-Z]apple|^apple |

| 2 | 577,683 | Media & ent. | |||

| 3 | Microsoft | 501,856 | Bus. tech. | microsoft | microsoft |

| 4 | Amazon | 468,737 | Retail | amazon | amazon |

| 5 | McDonald's | 191,109 | Fast food | mcdonalds | mcdonald.?s |

| 6 | Visa | 169,092 | Fin. serv. | visa | [^a-zA-Z]visa[^a-zA-Z]|^visa[^a-zA-Z]|[^a-zA-Z]visa$|^visa$ |

| 7 | Tencent | 141,020 | Media & ent. | tencent | tencent |

| 8 | Louis Vuitton | 124,822 | Luxury | louisvuitton | louis.?vuitton |

| 9 | Mastercard | 110,631 | Fin. serv. | mastercard | mastercard |

| 10 | Coca-Cola | 106,109 | Food & bev. | cocacola | coca.?cola |

| 11 | Aramco | 105,800 | Energy | aramco | aramco |

| 12 | 93,024 | Media & ent. | |||

| 13 | Oracle | 91,992 | Bus. tech. | oracle | oracle |

| 14 | Alibaba | 91,898 | Retail | alibaba | alibaba |

| 15 | AT&T | 88,999 | Telecoms | att | [^a-zA-Z]at.?t[^a-zA-Z]|^at.?t[^a-zA-Z]|[^a-zA-Z]at.?t$|^at.?t$ |

| 16 | Verizon | 88,976 | Telecoms | verizon | verizon |

| 17 | IBM | 87,662 | Bus. tech. | ibm | [^a-zA-Z]ibm[^a-zA-Z]|^ibm[^a-zA-Z]|[^a-zA-Z]ibm$|^ibm$ |

| 18 | Moutai | 87,524 | Alcohol | moutai | moutai |

| 19 | Hermès | 76,299 | Luxury | hermes | hermes|hermès |

| 20 | The Home Depot | 74,954 | Retail | homedepot | home.?depot |

| 21 | Nike | 74,890 | Apparel | nike | [^a-zA-Z]nike[^a-zA-Z]|^nike[^a-zA-Z]|[^a-zA-Z]nike$|^nike$ |

| 22 | Accenture | 73,640 | Bus. tech. | accenture | accenture |

| 23 | UPS | 73,598 | Logistics | ups | [^a-zA-Z]ups[^a-zA-Z]|^ups[^a-zA-Z]|[^a-zA-Z]ups$|^ups$ |

| 24 | Nvidia | 72,685 | Bus. tech. | nvidia | [^a-zA-Z]nvidia|^nvidia |

| 25 | Tesla | 67,662 | Automotive | tesla | tesla |

| 26 | Telekom / T-mobile |

65,103 | Telecoms | tmobile | deutsche.?telekom|[^a-zA-Z]t-?mobile|^t-?mobile |

| 27 | Starbucks | 61,534 | Fast food | starbucks | starbucks |

| 28 | Walmart | 59,873 | Retail | walmart | walmart |

| 29 | 58,947 | Media & ent. | |||

| 30 | Marlboro | 57,576 | Tobacco | marlboro | marlboro |

| 31 | Chanel | 55,939 | Luxury | chanel | chanel |

| 32 | Qualcomm | 54,013 | Bus. tech. | qualcomm | qualcomm |

| 33 | Costco | 53,383 | Retail | costco | costco[^a-zA-Z]|costco$ |

| 34 | YouTube | 53,007 | Media & ent. | youtube | you.?tube |

| 35 | Adobe | 51,247 | Bus. tech. | adobe | adobe |

| 36 | Netflix | 49,763 | Media & ent. | netflix | netflix |

| 37 | 48,529 | Media & ent. | linked.?in | ||

| 38 | Cisco | 47,171 | Bus. tech. | cisco | cisco |

| 39 | Disney | 46,970 | Media & ent. | disney | disney |

| 40 | Xfinity | 44,354 | Telecoms | xfinity | [^a-zA-Z]xfinity|^xfinity |

| 41 | TikTok | 44,349 | Media & ent. | tiktok | tiktok |

| 42 | TCS | 41,964 | Bus. tech. | tcs | [^a-zA-Z]tcs[^a-zA-Z]|^tcs[^a-zA-Z]|[^a-zA-Z]tcs$|^tcs$|tata.?consult |

| 43 | Texas Instruments |

41,276 | Bus. tech. | texas instruments |

texas.?instruments |

| 44 | Intuit | 38,617 | Bus. tech. | intuit | [^a-zA-Z]intuit[^a-zA-Z]|^intuit[^a-zA-Z]|[^a-zA-Z]intuit$|^intuit$ |

| 45 | L'Oréal Paris | 38,084 | Pers. care | loreal | l.?oreal|l.?oréal |

| 46 | Spectrum | 37,346 | Telecoms | spectrum | spectrum |

| 47 | American Express |

37,219 | Fin. serv. | american express |

american.?express|[^a-zA-Z]amex[^a-zA-Z]|^amex[^a-zA-Z]|[^a-zA-Z]amex$|^amex$ |

| 48 | SAP | 34,874 | Bus. tech. | sap | [^a-zA-Z]sap[^a-zA-Z]|^sap[^a-zA-Z]|[^a-zA-Z]sap$|^sap$ |

| 49 | Salesforce | 34,709 | Bus. tech. | salesforce | salesforce |

| 50 | AMD | 33,796 | Bus. tech. | amd | [^a-zA-Z]amd[^a-zA-Z]|^amd[^a-zA-Z]|[^a-zA-Z]amd$|^amd$|advanced.?micro.?devices |

| 51 | RBC | 33,744 | Fin. serv. | rbc | [^a-zA-Z]rbc[^a-zA-Z]|^rbc[^a-zA-Z]|[^a-zA-Z]rbc$|^rbc$|royal.?bank.*canada |

| 52 | Intel | 33,253 | Bus. tech. | intel | [^a-zA-Z]intel[^a-zA-Z]|^intel[^a-zA-Z]|[^a-zA-Z]intel$|^intel$ |

| 53 | Wells Fargo | 32,466 | Fin. serv. | wellsfargo | wells.?fargo |

| 54 | Samsung | 32,303 | Cons. tech. | samsung | samsung |

| 55 | Meituan | 32,029 | Cons. tech. | meituan | meituan |

| 56 | HDFC | 31,159 | Fin. serv. | hdfc | [^a-zA-Z]hdfc[^a-zA-Z]|^hdfc[^a-zA-Z]|[^a-zA-Z]hdfc$|^hdfc$ |

| 57 | United- Healthcare |

30,938 | Fin. serv. | united healthcare |

united.?healthcare |

| 58 | Huawei | 30,847 | Cons. tech. | huawei | huawei |

| 59 | Haier | 30,485 | IoT ecosys. | haier | haier |

| 60 | Xbox | 30,404 | Cons. tech. | xbox | [^a-zA-Z]xbox|^xbox |

| 61 | PayPal | 30,296 | Fin. serv. | paypal | paypal |

| 62 | Toyota | 28,513 | Automotive | toyota | toyota |

| 63 | Vodafone | 27,030 | Telecoms | vodafone | vodafone |

| 64 | JD | 26,601 | Retail | jdcom | [^a-zA-Z]jd.?com[^a-zA-Z]|^jd.?com[^a-zA-Z]|[^a-zA-Z]jd.?com$|^jd.?com$|jingdong |

| 65 | Gucci | 26,306 | Luxury | gucci | gucci |

| 66 | Infosys | 26,156 | Bus. tech. | infosys | infosys[^a-zA-Z]|infosys$ |

| 67 | TD | 25,969 | Fin. serv. | tdbank | [^a-zA-Z]td.?bank[^a-zA-Z]|^td.?bank[^a-zA-Z]|[^a-zA-Z]td.?bank$|^td.?bank$ |

| 68 | J.P. Morgan | 25,429 | Fin. serv. | jpmorgan | j.?p.?morgan |

| 69 | ICBC | 25,419 | Fin. serv. | icbc | icbc |

| 70 | Shein | 24,250 | Apparel | shein | shein |

| 71 | Mercedes-Benz | 23,978 | Automotive | mercedes | mercedes |

| 72 | Mercado Libre | 23,241 | Retail | mercadolibre | mercado.?libre |

| 73 | China Mobile | 23,231 | Telecoms | chinamobile | china.?mobile |

| 74 | BCA | 22,684 | Fin. serv. | bca | [^a-zA-Z]bca[^a-zA-Z]|^bca[^a-zA-Z]|[^a-zA-Z]bca$|^bca$|bank.?central.?asia |

| 75 | Chase | 22,431 | Fin. serv. | chase | [^a-zA-Z]chase[^a-zA-Z]|^chase[^a-zA-Z]|[^a-zA-Z]chase$|^chase$ |

| 76 | Airtel | 22,332 | Telecoms | airtel | [^a-zA-Z]airtel[^a-zA-Z]|^airtel[^a-zA-Z]|[^a-zA-Z]airtel$|^airtel$ |

| 77 | Siemens | 22,167 | Conglom. | siemens | siemens |

| 78 | CommBank | 22,069 | Fin. serv. | commbank | commbank|commonwealth.?bank |

| 79 | ExxonMobil | 22,068 | Energy | exxon | exxon |

| 80 | KFC | 22,056 | Fast food | kfc | [^a-zA-Z]kfc[^a-zA-Z]|^kfc[^a-zA-Z]|[^a-zA-Z]kfc$|^kfc$|kentucky.?fried.?chicken |

| 81 | Nongfu Spring | 21,764 | Food & bev. | nongfuspring | nongfu.?spring |

| 82 | Bank of America | 21,548 | Fin. serv. | bankof america |

bank.?of.?america |

| 83 | Lowe's | 21,500 | Retail | lowes | lowe.?s[^a-zA-Z]|lowe.?s$ |

| 84 | NTT | 21,385 | Telecoms | ntt | [^a-zA-Z]ntt[^a-zA-Z]|^ntt[^a-zA-Z]|[^a-zA-Z]ntt$|^ntt$|nippon.?telegraph |

| 85 | Ping An | 21,183 | Fin. serv. | pingan | [^a-zA-Z]ping.?an[^a-zA-Z]|^ping.?an[^a-zA-Z]|[^a-zA-Z]ping.?an$|^ping.?an$ |

| 86 | Ikea | 21,049 | Retail | ikea | [^a-zA-Z]ikea[^a-zA-Z]|^ikea[^a-zA-Z]|[^a-zA-Z]ikea$|^ikea$ |

| 87 | BMW | 20,944 | Automotive | bmw | [^a-zA-Z]bmw[^a-zA-Z]|^bmw[^a-zA-Z]|[^a-zA-Z]bmw$|^bmw$ |

| 88 | Budweiser | 19,888 | Alcohol | budweiser | budweiser |

| 89 | Lancôme | 19,400 | Pers. care | lancome | lancome|lancôme |

| 90 | AIA | 19,231 | Fin. serv. | aia | [^a-zA-Z]aia[^a-zA-Z]|^aia[^a-zA-Z]|[^a-zA-Z]aia$|^aia$ |

| 91 | Pepsi | 18,826 | Food & bev. | pepsi | pepsi |

| 92 | DHL | 18,723 | Logistics | dhl | [^a-zA-Z]dhl[^a-zA-Z]|^dhl[^a-zA-Z]|[^a-zA-Z]dhl$|^dhl$ |

| 93 | Red Bull | 18,554 | Food & bev. | redbull | red.?bull |

| 94 | Zara | 18,395 | Apparel | zara | [^a-zA-Z]zara[^a-zA-Z]|^zara[^a-zA-Z]|[^a-zA-Z]zara$|^zara$ |

| 95 | Colgate | 18,360 | Pers. care | colgate | colgate |

| 96 | Uber | 18,329 | Cons. tech. | uber | [^a-zA-Z]uber[^a-zA-Z]|^uber[^a-zA-Z]|[^a-zA-Z]uber$|^uber$ |

| 97 | FedEx | 18,231 | Logistics | fedex | [^a-zA-Z]fedex[^a-zA-Z]|^fedex[^a-zA-Z]|[^a-zA-Z]fedex$|^fedex$|federal.?express |

| 98 | Shell | 17,952 | Energy | shell | [^a-zA-Z]shell[^a-zA-Z]|^shell[^a-zA-Z]|[^a-zA-Z]shell$|^shell$ |

| 99 | Sony | 17,814 | Cons. tech. | sony | [^a-zA-Z]sony[^a-zA-Z]|^sony[^a-zA-Z]|[^a-zA-Z]sony$|^sony$ |

| 100 | Pampers | 17,376 | Pers. care | pampers | pampers |

Appendix B: Formulation of the proximity score for sentiment analysis

The score assigned when a sentiment keyword is identified near to a brand mention is determined by the proximity (in numbers of words) of the two words. In this analysis, we use an exponentially-decaying function (analagous to that used when considering the decay of a radioactive substance according to a half-life).

The proximity score, Sp, is defined as:

Sp = ⌊ Smax × (½)(p / p0.5) ⌋

where:

p is the proximity (in words)

p0.5 is the 'proximity half life' (i.e. the number of words' separation for the proximity score to drop to half of its maximum value)

⌊ ⌋ denotes the 'floor function' - i.e. rounding the value down to the greatest integer below the value in question

This provides a score profile as shown in Figure B.1.

Figure B.1: Proximity scores as a function of proximity, for four combinations of maximum score and proximity half life (shown in the key as: 'maximum score / proximity half-life')

Because of the action of rounding down utilised in the calculation, the maximum score acts as more than just a simple scaling factor; it controls the proximity at which the score drops to zero (i.e. the proximity beyond which a sentiment keyword is deemed not to relate to a brand mention). For the values used in this study (maximum score = 100; proximity half-life = 1 word), the values are as shown in Table B.1.

| Proximity (words) |

Proximity score |

|---|---|

| 1 | 100 |

| 2 | 50 |

| 3 | 25 |

| 4 | 12 |

| 5 | 6 |

| 6 | 3 |

| 7 | 1 |

| 8 | 0 |

Table B.1: Proximity scores for the parameters: maximum score = 100; proximity half-life = 1 word

Appendix C: Initial tests of the sentiment scoring algorithm

As part of the testing process for the sentiment scoring algorithm, one webpage featuring multiple brand references (https://en.wikipedia.org/wiki/Brand) was analysed to determine the sentiment scores for the top ten most valuable brands, in order to assess the meaningfulness of the results. The results are presented below, as an illustration of the types of content matched by the keyword libraries and proximity score formulation.

| Brand term |

No. of identified references |

Positive sentiment score |

Negative sentiment score |

Overall sentiment score |

|---|---|---|---|---|

| apple | 4 | 0 | 0 | 0 |

| 1 | 106 | 0 | 106 | |

| microsoft | 4 | 0 | 0 | 0 |

| amazon | 1 | 12 | 0 | 12 |

| mcdonalds | 0 | - | - | - |

| visa | 0 | - | - | - |

| tencent | 0 | - | - | - |

| louisvuitton | 1 | 3 | 0 | 3 |

| mastercard | 0 | - | - | - |

| cocacola | 12 | 44 | 0 | 44 |

Table C.1: Numbers of identified references and sentiment scores for each of the top ten brands, on the webpage https://en.wikipedia.org/wiki/Brand

Examples of the brand references contributing to the sentiment scores are shown below.

1. 'google' near 'flexible' (proximity 1; score component +100) and 'fun' (proximity 5; score component +6)

2. 'amazon' near 'vivid' (proximity 4; score component +12)

3. 'cocacola' near 'distinctive' (proximity 5; score component +6)

Appendix D: Overall prominence scores for all 100 brands

| Prominence ranking |

Kantar (brand value) ranking |

Brand term (encompasses all matched variants) |

Prominence score |

|---|---|---|---|

| 1 | 2 | 2.856 | |

| 2 | 3 | microsoft | 0.670 |

| 3 | 37 | 0.655 | |

| 4 | 4 | amazon | 0.637 |

| 5 | 12 | 0.523 | |

| 6 | 34 | youtube | 0.459 |

| 7 | 29 | 0.431 | |

| 8 | 1 | apple | 0.405 |

| 9 | 35 | adobe | 0.303 |

| 10 | 98 | shell | 0.168 |

| 11 | 13 | oracle | 0.157 |

| 12 | 49 | salesforce | 0.153 |

| 13 | 6 | visa | 0.143 |

| 14 | 87 | bmw | 0.129 |

| 15 | 41 | tiktok | 0.117 |

| 16 | 63 | vodafone | 0.111 |

| 17 | 48 | sap | 0.105 |

| 18 | 68 | jpmorgan | 0.087 |

| 19 | 39 | disney | 0.078 |

| 20 | 5 | mcdonalds | 0.073 |

| 21 | 36 | netflix | 0.069 |

| 22 | 52 | intel | 0.066 |

| 23 | 10 | cocacola | 0.065 |

| 24 | 86 | ikea | 0.062 |

| 25 | 84 | ntt | 0.058 |

| 26 | 99 | sony | 0.055 |

| 27 | 17 | ibm | 0.055 |

| 28 | 62 | toyota | 0.054 |

| 29 | 38 | cisco | 0.051 |

| 30 | 75 | chase | 0.051 |

| 31 | 47 | americanexpress | 0.049 |

| 32 | 21 | nike | 0.045 |

| 33 | 28 | walmart | 0.038 |

| 34 | 71 | mercedes | 0.038 |

| 35 | 60 | xbox | 0.034 |

| 36 | 25 | tesla | 0.033 |

| 37 | 22 | accenture | 0.032 |

| 38 | 54 | samsung | 0.031 |

| 39 | 9 | mastercard | 0.031 |

| 40 | 23 | ups | 0.030 |

| 41 | 53 | wellsfargo | 0.027 |

| 42 | 83 | lowes | 0.027 |

| 43 | 91 | pepsi | 0.027 |

| 44 | 7 | tencent | 0.026 |

| 45 | 45 | loreal | 0.024 |

| 46 | 95 | colgate | 0.023 |

| 47 | 77 | siemens | 0.023 |

| 48 | 65 | gucci | 0.020 |

| 49 | 79 | exxon | 0.020 |

| 50 | 46 | spectrum | 0.019 |

| 51 | 33 | costco | 0.016 |

| 52 | 44 | intuit | 0.015 |

| 53 | 27 | starbucks | 0.015 |

| 54 | 24 | nvidia | 0.014 |

| 55 | 15 | att | 0.014 |

| 56 | 11 | aramco | 0.011 |

| 57 | 61 | paypal | 0.010 |

| 58 | 74 | bca | 0.010 |

| 59 | 80 | kfc | 0.009 |

| 60 | 96 | uber | 0.009 |

| 61 | 42 | tcs | 0.008 |

| 62 | 20 | homedepot | 0.008 |

| 63 | 50 | amd | 0.007 |

| 64 | 51 | rbc | 0.007 |

| 65 | 82 | bankofamerica | 0.007 |

| 66 | 66 | infosys | 0.006 |

| 67 | 90 | aia | 0.006 |

| 68 | 14 | alibaba | 0.005 |

| 69 | 16 | verizon | 0.005 |

| 70 | 31 | chanel | 0.005 |

| 71 | 56 | hdfc | 0.005 |

| 72 | 92 | dhl | 0.005 |

| 73 | 26 | tmobile | 0.004 |

| 74 | 8 | louisvuitton | 0.003 |

| 75 | 70 | shein | 0.003 |

| 76 | 69 | icbc | 0.002 |

| 77 | 19 | hermes | 0.001 |

| 78 | 30 | marlboro | 0.001 |

| 79 | 94 | zara | 0.001 |

| 80 | 32 | qualcomm | 0.001 |

| 81 | 58 | huawei | 0.001 |

| 82 | 64 | jdcom | 0.001 |

| 83 | 76 | airtel | 0.001 |

| 84 | 93 | redbull | 0.001 |

| 85 | 97 | fedex | 0.001 |

| 86 | 59 | haier | 0.001 |

| 87 | 100 | pampers | 0.001 |

| 88 | 43 | texasinstruments | 0.000 |

| 89 | 67 | tdbank | 0.000 |

| 90 | 18 | moutai | 0.000 |

| 91 | 73 | chinamobile | 0.000 |

| 92 | 78 | commbank | 0.000 |

| 93 | 85 | pingan | 0.000 |

| 94 | 88 | budweiser | 0.000 |

| 95 | 40 | xfinity | 0.000 |

| 96 | 55 | meituan | 0.000 |

| 97 | 57 | unitedhealthcare | 0.000 |

| 98 | 72 | mercadolibre | 0.000 |

| 99 | 81 | nongfuspring | 0.000 |

| 100 | 89 | lancome | 0.000 |

Appendix E: Additional large Internet and/or social-media brands for analysis

Regex key:

\. An exact dot ('.')

| Brand |

Regex matching string |

|---|---|

| Baidu | baidu |

| Booking.com | booking\.?com |

| Douyin | douyin |

| Kuaishou | kuaishou |

| Pinduoduo | pinduoduo |

| [^a-zA-Z]qq[^a-zA-Z]|^qq[^a-zA-Z]|[^a-zAZ]qq$|^qq$ | |

| ServiceNow | service-?now |

| Sina Weibo | |

| Snapchat | snap-?chat |

| Telegram | telegram |

| Twitter / X | twitter|[^a-zA-Z]x\.com[^a-zA-Z]|^x\.com[^azA-Z]|[^a-zA-Z]x\.com$|^x\.com$ |

| whats-?app | |

| Yandex | yandex |

Appendix F: Overall sentiment scores for all 100 brands*

* Excluding any brands for which no references were identified

| Sentiment ranking |

Kantar (brand value) ranking |

Brand term |

Sentiment score |

|---|---|---|---|

| 1 | 4 | amazon | 22.48 |

| 2 | 3 | microsoft | 21.47 |

| 3 | 2 | 20.81 | |

| 4 | 12 | 13.67 | |

| 5 | 1 | apple | 13.48 |

| 6 | 53 | wellsfargo | 11.45 |

| 7 | 37 | 10.47 | |

| 8 | 49 | salesforce | 10.45 |

| 9 | 10 | cocacola | 10.29 |

| 10 | 54 | samsung | 10.17 |

| 11 | 36 | netflix | 9.92 |

| 12 | 35 | adobe | 9.70 |

| 13 | 47 | americanexpress | 9.70 |

| 14 | 21 | nike | 9.34 |

| 15 | 34 | youtube | 9.15 |

| 16 | 60 | xbox | 8.46 |

| 17 | 23 | ups | 8.40 |

| 18 | 84 | ntt | 8.34 |

| 19 | 28 | walmart | 8.29 |

| 20 | 29 | 8.20 | |

| 21 | 95 | colgate | 7.74 |

| 22 | 68 | jpmorgan | 7.11 |

| 23 | 6 | visa | 6.97 |

| 24 | 9 | mastercard | 6.65 |

| 25 | 71 | mercedes | 6.51 |

| 26 | 75 | chase | 6.43 |

| 27 | 87 | bmw | 6.32 |

| 28 | 82 | bankofamerica | 5.97 |

| 29 | 22 | accenture | 5.62 |

| 30 | 8 | louisvuitton | 5.37 |

| 31 | 13 | oracle | 5.17 |

| 32 | 100 | pampers | 5.00 |

| 33 | 65 | gucci | 4.59 |

| 34 | 41 | tiktok | 4.51 |

| 35 | 56 | hdfc | 4.26 |

| 36 | 89 | lancome | 4.18 |

| 37 | 33 | costco | 4.09 |

| 38 | 99 | sony | 4.01 |

| 39 | 61 | paypal | 3.42 |

| 40 | 48 | sap | 3.42 |

| 41 | 26 | tmobile | 3.10 |

| 42 | 86 | ikea | 3.09 |

| 43 | 17 | ibm | 2.98 |

| 44 | 97 | fedex | 2.95 |

| 45 | 80 | kfc | 2.93 |

| 46 | 77 | siemens | 2.92 |

| 47 | 91 | pepsi | 2.85 |

| 48 | 38 | cisco | 2.85 |

| 49 | 7 | tencent | 2.76 |

| 50 | 98 | shell | 2.74 |

| 51 | 51 | rbc | 2.38 |

| 52 | 62 | toyota | 2.25 |

| 53 | 90 | aia | 2.22 |

| 54 | 16 | verizon | 2.07 |

| 55 | 67 | tdbank | 1.98 |

| 56 | 96 | uber | 1.75 |

| 57 | 25 | tesla | 1.64 |

| 58 | 27 | starbucks | 1.53 |

| 59 | 39 | disney | 1.39 |

| 60 | 46 | spectrum | 1.38 |

| 61 | 45 | loreal | 1.33 |

| 62 | 24 | nvidia | 1.15 |

| 63 | 66 | infosys | 1.03 |

| 64 | 92 | dhl | 1.02 |

| 65 | 52 | intel | 1.01 |

| 66 | 15 | att | 1.00 |

| 67 | 31 | chanel | 0.89 |

| 68 | 44 | intuit | 0.84 |

| 69 | 32 | qualcomm | 0.83 |

| 70 | 19 | hermes | 0.77 |

| 71 | 5 | mcdonalds | 0.69 |

| 72 | 50 | amd | 0.50 |

| 73 | 18 | moutai | 0.00 |

| 74 | 43 | texasinstruments | 0.00 |

| 75 | 59 | haier | 0.00 |

| 76 | 64 | jdcom | 0.00 |

| 77 | 74 | bca | 0.00 |

| 78 | 83 | lowes | 0.00 |

| 79 | 93 | redbull | 0.00 |

| 80 | 63 | vodafone | -0.01 |

| 81 | 94 | zara | -0.14 |

| 82 | 42 | tcs | -0.30 |

| 83 | 79 | exxon | -0.35 |

| 84 | 14 | alibaba | -0.53 |

| 85 | 76 | airtel | -1.05 |

| 86 | 20 | homedepot | -1.36 |

| 87 | 11 | aramco | -1.61 |

| 88 | 58 | huawei | -1.69 |

| 89 | 70 | shein | -2.07 |

| 90 | 69 | icbc | -2.71 |

References

[1] https://www.kantar.com/inspiration/brands/revealed-the-worlds-most-valuable-brands-of-2023

[2] https://www.iamstobbs.com/measuring-brand-prominence-of-fashion-brands-ebook

[3] Findings are based on results returned and analysis of live webpage content as of 14-Nov-2023

[4] https://www.businessweekly.co.uk/news/hi-tech/9121-online-research-gives-insight-damage-banks-brands

[5] https://www.trademarksandbrandsonline.com/news/luxury-brands-not-doing-enough-to-protect-themselves-online-4482 (cache available at https://webcache.googleusercontent.com/search?q=cache:9oyTNc1E1AwJ:https://www.trademarksandbrandsonline.com/news/luxury-brands-not-doing-enough-to-protect-themselves-online-4482&sca_esv=580550388)

[6] 'The Digital Brand Risk Index: A NetNames Report'; PDF available at https://silo.tips/download/the-digital-brand-risk-index-a-netnames-report

[7] 'Technical aspects of brand monitoring', internal Stobbs training presentation

[9] https://ptrckprry.com/course/ssd/data/positive-words.txt

[10] https://ptrckprry.com/course/ssd/data/negative-words.txt

[11] Minqing Hu and Bing Liu. 'Mining and Summarizing Customer Reviews', Proceedings of the ACM SIGKDD International Conference on Knowledge Discovery and Data Mining (KDD-2004), Aug 22-25, 2004, Seattle, Washington, USA.

[12] http://news.bbc.co.uk/1/hi/technology/4468745.stm

[13] https://www.investopedia.com/articles/personal-finance/030415/worlds-top-10-internet-companies.asp

[14] https://www.statista.com/statistics/209331/largest-us-internet-companies-by-market-cap/

[15] https://en.wikipedia.org/wiki/List_of_largest_Internet_companies

[16] https://www.statista.com/statistics/272014/global-social-networks-ranked-by-number-of-users/

[17] Findings from this additional study are based on analysis of live webpage content as of 27-Nov-2023. The analysis was also repeated on this date for the Google brand, which found that its overall prominence score was 2.855 (i.e. within 0.008% of its original value of 2.856) (with appearances on 481 pages in the dataset, cf. 476 previously), consistent with the assertion that there have been only minimal changes to the content of the set of webpages in the intervening two-week period, and that the prominence scores for these additional brands can therefore be compared with those presented above for the top 100 most valuable brands, on a like-for-like basis.

[18] https://www.ft.com/content/d3c7259c-0ea6-414b-9013-ac615b1a8177

[19] https://www.tyrepress.com/2011/09/michelin-still-top-online-brand-but-the-gaps-narrowing/

[20] https://www.tyrepress.com/2016/10/michelin-returns-to-the-top-of-online-brand-ranking/

[21] https://www.tyrepress.com/2017/09/michelin-tops-online-brand-prominence-table/

[22] https://www.kantar.com/inspiration/brands/revealed-the-worlds-most-valuable-brands-of-2023: 'Kantar BrandZ brand valuation methodology', pp. 172-174

[23] https://www.lyst.com/data/the-lyst-index/q323/

This article was first published as an e-book on 5 January 2024 at:

https://www.iamstobbs.com/online-brand-prominence-and-sentiment-ebook

Also published in the Q2 2024 IACC newsletter at:

https://8089757.hs-sites.com/iacc-quarterly-newsletter-q2-2024-issue

.jpg)

.jpg)

.jpg)

.jpg)

No comments:

Post a Comment